Selling Your Business

Preparing Your Business for Sale

We are not fans of “planning to sell your business” because this often creates dysfunctional decision making that frequently backfires.

In the end, it is better to build a business which is a pleasure to own and run because this is exactly the type of business that interested parties will want to acquire. Therefore, we would typically adopt the same approach as we do for Growth businesses with one added dimension: if the entrepreneur has one eye on a potential exit, then it is important to understand the types of business that potentially interested parties are looking to buy. In this case, it might be a business that is not just successful in the UK but has also demonstrated that it can replicate that success in another major market. Similarly working with multinational strategic partners in other markets successfully often end up as acquisitions themselves are that relationship is seen as a reason for the acquisition. It is often these special elements of a business that increases it attractiveness and perceived value to potential buyers.

There are exceptions of course – for example unicorn type businesses that develop technologies, never earn a profit and have to establish a market leading position before an interested party wants to acquire it. This is a high risk strategy which frequently requires a series of funding rounds from investors and a continual focus on staying ahead of the competition both in terms of developing product and securing the highest profile customers. This is highly stressful and strong finance director involvement is important because the key ingredient to success is the continued support of investors to provide not just the initial round of investment but to follow on in future rounds and to help with instructions to more significant funders as the business grows.

It is certainly true that the strength of the management team and its ability to adapt and evolve its plan is critical to the success as customer needs change and the emergence of competition narrows the window of opportunity. The core role of a finance director in this type of business is to monitor the performance and identify the key moments when changes in the plan or the team might be required.

Invariably the investors may be more willing to gamble because they have many more “irons in the fire” – so to speak – when the management team may have put their own houses on the line in pursuit of this success alone. Therefore whilst there is a great deal of alignment, this subtle difference in risk attitude often causes fractures between outside investors and management.

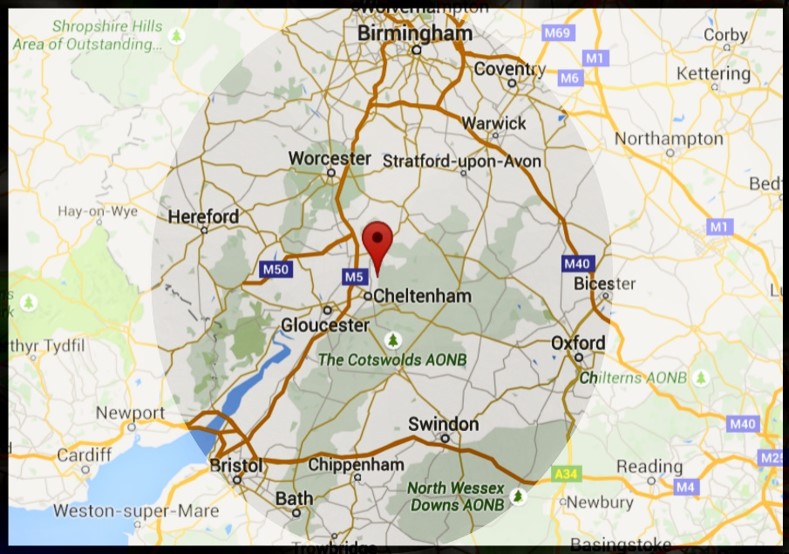

Region covered

Birmingham to Bristol and Hereford to Oxford.