Equity Investment & Bank Funding

Raise Money for your Business

If you are considering bank funding to help your business grow please see the section describing Finance Director services related to growing companies or turnaround situations.

There are some streams of funding available that do not result in selling part of your equity or control. These are typically mezzanine funding which is typically more expensive than bank funding or grants.

Seeking outside equity investment is another area entirely and more closely related to preparing your business for sale.

The decision to seek the involvement of outside investors is not an easy one to take. Many entrepreneurs see the business as their own and therefore the involvement of others and being held accountable is difficult.

However Covid 19 may well see a shift in attitudes. Many traditional businesses will have taken on significant debt that is unrelated to capital investment – for the first time. The prospect that the banks will be much more cautious in 2021 to fund growth may leave those businesses facing the prospect of seeking investment from 3rd parties for the first time.

This can be scary, but it is important to go into the process with your eyes wide open and being prepared to commit a significant amount of time talking to people who will ultimately say no. There is a great deal of luck involved so it is important to maximise your chances of being lucky by preparing well and exploiting every possible contact you have and following up referrals of referrals. Corporate finance boutiques can help although we always advise that you should select the boutique based on their contacts rather than their ability to prepare a good information memorandum.

Angel Investors will either want to invest in something they understand very well and feel that they can contribute towards the success or invest as part of a syndicate where there is a lead investor with expertise. Professional investors eg private equity and venture capital will typically have areas of focus that will change over time and will be very focused on the scale of the investment and how much they can earn from it.

Unicorn type businesses that develop technologies, never earn a profit and have to establish a market leading position before an interested party wants to acquire it are often the targets for these professional firms. This is a high risk strategy which frequently requires a series of funding rounds from investors and a continual focus on staying ahead of the competition both in terms of developing product and securing the highest profile customers. This is highly stressful and strong finance director involvement is important because the key ingredient to success is the continued support of investors to provide not just the initial round of investment but to follow on in future rounds and to help with instructions to more significant funders as the business grows.

It is certainly true that the strength of the management team and its ability to adapt and evolve its plan is critical to the success as customer needs change and the emergence of competition narrows the window of opportunity. The core role of a finance director in this type of business is to monitor the performance and identify the key moments when changes in the plan or the team might be required.

Invariably the investors may be more willing to gamble because they have many more “irons in the fire” – so to speak – when the management team may have put their own houses on the line in pursuit of this success alone. Therefore whilst there is a great deal of alignment, this subtle difference in risk attitude often causes fractures between outside investors and management.

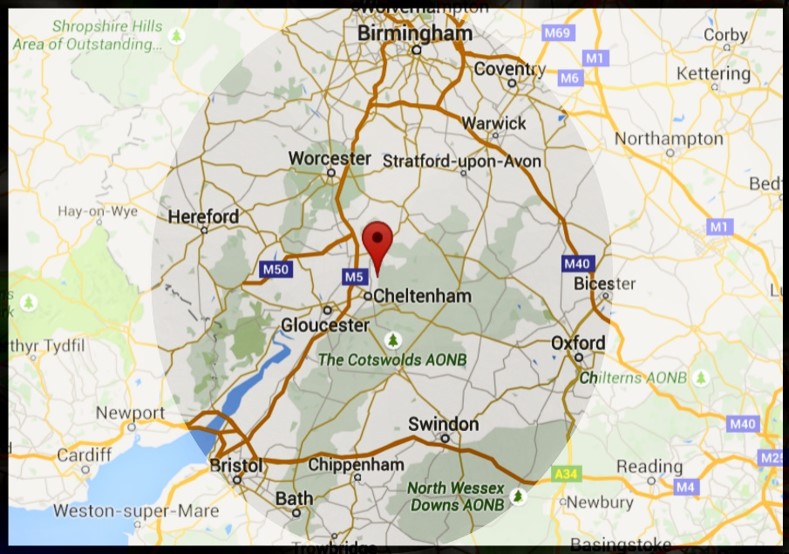

Region covered

Birmingham to Bristol and Hereford to Oxford.